Survey Defines Custom-Built Home Demographics

Smaller homes, tighter budgets, younger clients — these are some of the changes that have taken place in the custom-home market in recent years. Custom builders who survived the recession are hopeful that 2011 will bring more stability, but they’re not necessarily counting on the same business model to restore profitability.

In December 2010, Custom Builder surveyed 281 readers about their clients, their business challenges, and opportunities they foresee in the immediate future. Not surprisingly, most report a slowdown in activity. About one-third said they are building one to four fewer homes, compared to three years ago. About 25 percent said their output is down by five to 19 homes.

While the majority of respondents (about 39 percent) said the square footage of their homes has remained the same, approximately 35 percent report that it has decreased slightly, anywhere from 1 to 9 percent. Average size is in the 3,000- to 3,500-square-foot range for roughly 25 percent of respondents. But nearly 22 percent are building homes of more than 4,000 square feet. The average annual household income of their clients is more than $250,000, according to almost 37 percent of respondents. And nearly 31 percent said their clients want a significantly larger home — more than 500 square feet larger than their current residence.

Most respondents build for move-up buyers (79.5 percent). Retirees are further down the list (31.3 percent), as are move downs (23.1 percent). The typical client is age 45 to 55, said 46 percent of builders. However, nearly 28 percent said their typical client is 35 to 45 years old — a somewhat younger group than many custom builders are accustomed to serving.

One-fourth of respondents said that between 26 and 50 percent of their customers have children, elderly parents, or other family members living with them. And 29 percent report that 26 to 50 percent of clients are looking for a home that will allow them to age in place, as well as accommodate older relatives or “boomerang” children.

To accommodate clients that plan on having multiple generations living in their home, Lexington, Ky., builder Gatewood Arnold recommends a full bath instead of a powder room adjacent to the first-floor guest room, so it can be used as an office now and an in-law suite later if needed. Grady Burnette of Burnette Builders in Austin, Texas, has installed three elevators in the last 18 months. “The clients don’t need the elevator now, but they see it as something they’re going to need later, for themselves or some member of their family,” Burnette said.

Flash, function, and budgets

There will always be a demand for specialty rooms that reflect clients’ personal tastes and hobbies and ramp up the “wow” factor for visitors. Homes featured in past issues of Custom Builder have included such things as saddle rooms, trophy rooms, and automobile showrooms. More common are home theaters and outdoor kitchens. “We do outdoor kitchens with almost every house,” said Tiffany Pixler of Platinum Homes, Scottsdale, Ariz. “And theaters are still very popular.”

Estes Builders of Sequim, Wash., finds creative ways to satisfy a client’s desire for bells and whistles without blowing the budget. For instance, the builder might turn an unfinished basement storage room into a wine room.

“Flex space is something that we’re seeing people focus a little bit more on,” said Estes’ Rick Gross. “Instead of having a dedicated dining room, library, and home office, they’re looking at spaces that can have a combination of uses.”

Thirty-eight percent of respondents said that less than 10 percent of their clients prefer unfinished flex space to finished rooms with specific purposes. About one-fourth of builders said that 11 to 50 percent of customers are looking for unfinished flex space.

The unsteadiness of the economy is reflected in client budgets. Thirty percent of respondents said budgets are slightly lower today (1 to 5 percent) than they were three years ago. Another 30 percent said budgets are significantly lower, more than 5 percent. On average, clients budget between $250,000 and $500,000 for a new custom home, report 30 percent of respondents.

Gross said clients with budgetary constraints are a big challenge. “Budgets are smaller now than they have been historically,” he said. “People want more for the dollars they’re spending; they expect a deal. That’s just normal.”

Looking ahead

Custom builders have certain issues that affect them more than production builders, such as low appraisals that undercut the value of the homes they build. Asked what they thought would be their biggest business challenges in the next two years, respondents listed these top three: the ongoing recession (67.3 percent); low profit margins (63.7 percent); and continued softness in home prices (54.7 percent). Changing appraisals/low appraisals was fourth (50.9 percent), followed by getting customers qualified (50.7 percent).

Scott Branc of New Urban Home Builders, Austin, Texas, said his clients appreciate the intrinsic value of a green-built home, but appraisers? Not so much. “I’m working on a house right now that’s probably going to be a four-star Green Built, but the appraisers are comparing it to every other house built only to the minimum standard,” he said.

“We’re seeing a scarcity of skilled trade contractors,” said Platinum Homes’ Pixler. “The higher-paid skilled trades are being let go, and it’s harder to get the level of workmanship we used to get.”

Another serious issue is the difficulty clients have in obtaining mortgages. Financing isn’t a slam dunk, even for well-qualified clients. “A lot of my work in the past two years has been purely cash,” said Branc. “I think clients just don’t want to deal with the banks.”

When builders were asked about their top opportunities for business growth heading into 2011, the answers ranged from terse and pessimistic (“I know of few at this point”) to proactive (“Employ a broader base of operations to include new construction, remodeling, foreclosure buys, and joint ventures”).

Remodeling now accounts for 30 to 40 percent of Platinum Homes’ business, “which is fantastic,” said Pixler. “It’s opened us up to a younger demographic. We’re also providing home-care services for seasonal residents.”

When his stream of clients dried up two years ago, Nick DiCosola of Distinguished Dwellings in Hinsdale, Ill., started fixing up bank- and real-estate-owned properties. “I’m working on $5 million homes, so it’s still a custom-home market — it’s just that my client is the bank,” DiCosola said. In 2010 alone, he sold $70 million worth of residential real estate. He hasn’t given up on the home building market, “but there’s no one banging on my door either, so I’m not going to wait for that.”

And yet, people still build custom homes. About 71 percent of builders said it’s because the client wants a specific design, floor plan, and features. Close behind is the desire to build in a specific location (59 percent). The third most important reason is one every custom builder can appreciate: the client wants more personalized attention and service than a production builder can offer (58 percent). What hews closest to the custom builder’s true calling, though, is “they want a one-of-a-kind home that won’t be built again.” That’s what this business is all about.

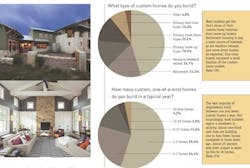

What type of custom homes do you build?

- Primary move-up buyer 79.5%

- Retirement 31.3%

- Vacation/weekend retreat 25.7%

- Primary move-down buyer 23.1%

- Primary first-time buyer 14.0%

- Other 4.8%

How many custom, one-of-a-kind homes do you build in a typical year?

- 1-3 homes 55.2%

- 4-7 homes 24.4%

- 8-12 homes 13.6%

- 13-20 homes 3.6%

- More than 20 homes 3.2%

Base: 281; Custom Builder Demographics Survey, Dec. 2010

What is the price range for the typical custom homes you build?

- Less than $250,000 6.1%

- $250,000 - $500,000 31.1%

- $500,000 - $750,000 27.1%

- $750,000 - $1 million 17.3%

- $1 million - $1.25 million 6.1%

- $1.25 million - $1.5 million 2.5%

- More than $1.5 million 9.8%

Base: 277; Custom Builder Demographics Survey, Dec. 2010

Excluding the cost of land, what’s the cost per square foot of your average custom-home project?

- More than $400/sf 2.2%

- $350/sf - $400/sf 2.9%

- $300/sf - $350/sf 8.3%

- $250/sf - $300/sf 15.9%

- $200/sf - $250/sf 21.1%

- $150/sf - $200/sf 27.9%

- Less than $150/sf 21.7%

Base: 276; Custom Builder Demographics Survey, Dec. 2010

On average, what is the square footage of the homes you build?

- Less than 2,000 sf 5.1%

- 2,000-2,500 sf 12.8%

- 2,500-3,000 sf 20.9%

- 3,000-3,500 sf 24.5%

- 3,500-4,000 sf 14.7%

- More than 4,000 sf 22.0%

Base: 273; Custom Builder Demographics Survey, Dec. 2010

Has the average square footage of your custom homes increased or decreased over the last three years?

- Increased significantly (more than 10 percent) 2.92%

- Increased slightly (1-9 percent) 9.04%

- About the same 37.61%

- Decreased slightly (1-9 percent) 34.69%

- Decreased significantly (more than 10 percent) 15.74%

Base: 273; Custom Builder Demographics Survey, Dec. 2010

Do you own land or build on customer-owned lots?

- I build strictly on customer-owned land 51.1%

- I buy lots in subdivisions 12.0%

- I buy infill sites 6.2%

- I develop custom-home communities 4.1%

- All of the above 26.6%

Base: 274; Custom Builder Demographics Survey, Dec. 2010

What is the age range of your typical custom-home client?

- Younger than 35 1.5%

- 35-45 27.7%

- 45-55 46.4%

- 55-65 23.7%

- Older than 65 0.7%

Base: 274; Custom Builder Demographics Survey, Dec. 2010

How does that age range compare to your clients of three years ago?

- We have younger clients today 13.02%

- About the same age range 71.30%

- We have older clients today 15.68%

Base: 274; Custom Builder Demographics Survey, Dec. 2010

What is your typical client’s annual household income?

- Less than $100,000 9.4%

- $101,000-$150,000 20.4%

- $151,000-$200,000 22.3%

- $201,000-$250,000 10.9%

- More than $250,000 37.0%

Base: 265; Custom Builder Demographics Survey, Dec. 2010

On average, how much do your average clients budget for their custom-home project?

- Less than $250,000 11.18%

- $250,000 - $500,000 30.88%

- $500,000 - $750,000 24.41%

- $750,000 - $1 million 14.41%

- $1 million - $1.25 million 6.47%

- $1.25 million - $1.5 million 5.29%

- More than $1.5 million 7.35%

Base: 281; Custom Builder Demographics Survey, Dec. 2010

How do client budgets today compare with those of three years ago?

- Budgets are significantly higher today (more than 5 percent higher) 4.0%

- Budgets are slightly higher today (1-5 percent higher) 9.2%

- About the same 25.7%

- Budgets are slightly lower today (1-5 percent lower) 30.5%

- Budgets are significantly lower today (more than 5 percent lower) 30.6%

Base: 272; Custom Builder Demographics Survey, Dec. 2010

Is the custom home your clients wish to build smaller or larger than their current home?

- Significantly larger (more than 500 sf larger) 28.36%

- Slightly larger (50 - 499 sf larger) 29.85%

- About the same size 17.91%

- Slightly smaller (50 - 499 sf smaller) 14.93%

- Significantly smaller (more than 500 sf smaller) 8.96%

Base: 274; Custom Builder Demographics Survey, Dec. 2010

How important are energy-efficient/green features to your clients?

- Extremely important 22.0%

- Somewhat important 57.9%

- Neither important nor unimportant 15.4%

- Somewhat unimportant 3.3%

- Not at all important 1.4%

Base: 277; Custom Builder Demographics Survey, Dec. 2010

Approximately what percentage of your custom-home clients have children, elderly parents, or other family members living at home?

- Less than 10 percent 21.35%

- 11-25 percent 18.71%

- 26-50 percent 26.32%

- 51-75 percent 18.71%

- More than 75 percent 14.91%

Base: 274; Custom Builder Demographics Survey, Dec. 2010

What percentage of clients are looking for a home where they can age in place and also provide living space for elderly relatives or boomerang kids?

- Less than 10 percent 23.37%

- 11-25 percent 23.67%

- 26-50 percent 27.51%

- 51-75 percent 19.53%

- More than 75 percent 5.92%

Base: 276; Custom Builder Demographics Survey, Dec. 2010

Do you regularly measure customer satisfaction?

- Yes, we measure regularly using a third-party service 9.1%

- Yes, we measure regularly using an in-house process 43.4%

- Yes, we measure, but only occasionally 26.6%

- We don’t measure 20.9%

Base: 280; Custom Builder Demographics Survey, Dec. 2010

In the next two years, which of the following do you believe will be your biggest business challenges?

- Ongoing recession 67.3%

- Low profit margins 63.7%

- Continued softness in home prices 54.7%

- Changing appraisals/low appraisals 50.9%

- Mortgage banking – getting customers qualified 50.7%

- Business banking – funding for projects 49.7%

- Higher labor/material costs 45.0%

- Competing with foreclosed homes 43.9%

- More demanding clients 39.8%

- Marketing – Finding qualified buyers and prospects 35.4%

- Government regulations 32.7%

- Local permitting fees and taxes 30.7%

- Competition from larger production builders that have entered the custom market 24.3%

- Scarcity of skilled trade contractors 24.2%

- Finding qualified employees 19.0%

- Managing cash 17.0%

Base: 281; Custom Builder Demographics Survey, Dec. 2010

What’s on the top of your clients’ wish list in terms of special rooms and floor-plan features?

- Master suite retreat 67.3%

- His/hers home offices 47.1%

- Home theater 38.3%

- Outdoor kitchen 35.9%

- In-law suite 26.6%

- Craft/hobby room 21.3%

- Bar/pub space 15.5%

- Guest casita 10.8%

- Art gallery 2.3%

- Automobile showroom 2.0%

- Trophy room 1.5%

- Saddle room 1.0%

- Other 8.8%

Base: 281; Custom Builder Demographics Survey, Dec. 2010

Why do your clients choose a custom home over a production home?

- Want to build in a specific location 23.7%

- Want a specific design and floor plan and features 27.3%

- They want more square footage than what production builders offer 6.1%

- Production homes don’t have what they’re looking for 18.6%

- Want more personalized attention and service than a production builder can offer 22.2%

- Other 15 2.1%

Base: 281; Custom Builder Demographics Survey, Dec. 2010

What percentage of clients prefer flexible space that can be finished later (say in the basement or over the garage) to fully finished rooms with specific purposes?

- Less than 10 percent 38.28%

- 11-25 percent 25.22%

- 26-50 percent 24.63%

- 51-75 percent 9.20%

- More than 75 percent 2.67%

Base: 281; Custom Builder Demographics Survey, Dec. 2010

Methodology

The survey was distributed on December 7, 2010, to a random sample of 29,000 Custom Builder readers. A reminder was deployed on Dec. 13. No incentive was offered. By the closing date of Dec. 14, a total of 281 eligible readers had responded.